The logjam that’s bedeviled the market for existing homes in the Reno area these many months is about to begin breaking loose.

Unfortunately, the slow return to a market that’s closer to normal will be painful for some buyers — particularly first-time buyers — who will find themselves priced out of the market for a while.

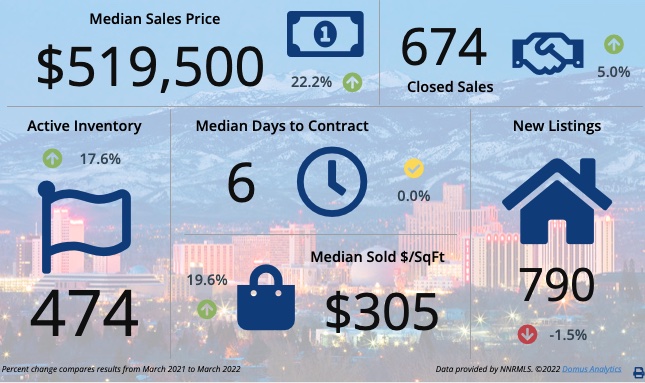

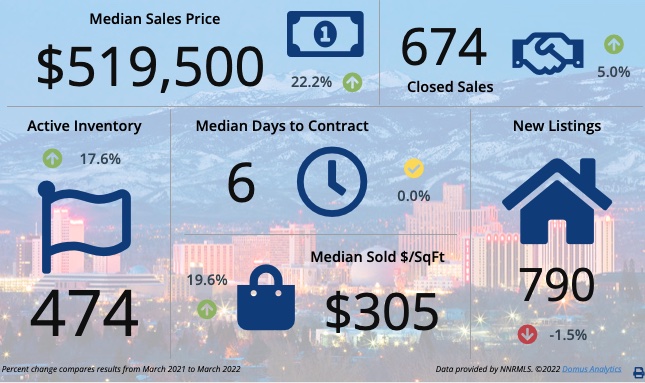

The transition away from a white-hot market isn’t evident in the most recent Market Report developed by the Reno/Sparks Association of Realtors. That report shows continued strong sales with a 2.9 percent increase in the median sales price of an existing home in March compared with a month earlier. Homes are under contract an average of five days after they’re listed — and because that’s an average, it means some homes are under contract even faster. Courtesy

Courtesy

March statistics for single family homes, condos in the Reno/Sparks and Fernley area.

Because those figures run only to the start of April, they don’t capture the cooling of the market that’s already developing as the Federal Reserve boosts interest rates in its effort to control inflation.

The rate for a 30-year, fixed-rate mortgage recently has run about 5 percent, up from about 3.2 percent at the start of this year. For the buyer of a $575,000 home — the median price in Reno-Sparks these days — that increase in interest cost amounts to nearly $500 more each month, assuming a 20 percent down payment.

While we don’t yet have statistics for April, we’ve heard anecdotally that the increase is sending some potential purchasers to the sidelines, at least for a while as they save for a larger down payment and figure out their options. We’re hearing, too, that some homeowners are becoming more motivated to list their properties while the market remains strong.

Both these factors — fewer buyers and more properties listed for sale — will bring the market for existing homes back into balance.

Since early 2020, we’ve simply seen too many buyers chasing too few homes. Potential sellers have been reluctant to put their homes on the market, knowing that they’d then have to turn around and face the challenges of buying their next home in a hot market. Buyers, meanwhile, find few choices. The result has been bidding wars, strong price appreciation and mounting frustration among families who want to buy a home.

The big question now is how quickly the market will return to more normal conditions. While opinions vary among members of the Reno/Sparks Association of Realtors, most expect a soft landing, a steady cooldown that lasts through the rest of this year.

It’s important to remember that the market for existing homes in the Reno-Sparks area is driven by strong fundamentals. The region’s strong economy continues to draw new families to the region. Many earn good salaries. Some come from areas such as the San Francisco Bay where housing is less affordable. Northern Nevada is attractive, too, to remote workers who want the advantages of Nevada’s outdoors lifestyle. These fundamentals remain in place even as mortgage interest rates tick up.

So, even while the cooldown begins, buyers still will need to practice patience. They’ll still need to make sure they have preapproval (not just preauthorization) from a lender. They’ll still need to be prepared to move quickly. It’s going to be challenging for much of the rest of this year.

For sellers, meanwhile, this remains a very attractive market, especially for families who are selling in the high-priced Reno-area market and moving to a lower-priced city elsewhere in the United States. But they may find that they’ll be waiting more than average of five days to get an offer, and bidding wars may be less common.

Change is coming.

Sarah Scattini, a Realtor with RE/MAX Premier Properties in Reno, is 2022 President of the Reno/Sparks Association of Realtors.

Courtesy

Courtesy